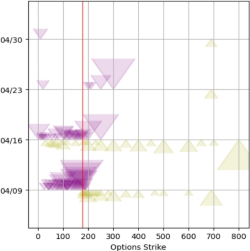

This website tracks the order flow sentiment for the specified symbol for contracts over the next 4 expiration dates.

Open Interest Data Available After 11:00 UTC

Popular stocks:

Use the links bellow for the most popular options contracts:

$GME Gamestop $AMC AMC Options $PLTR Palantir $BB BlackBerry $NOK Nokia $RKT Rocket Companies Inc. $SNDL SunDialSearch for a different stock:

What can I learn from options contracts sentiment?

Options order flow can be a great tool to indicate the future direction of movement of any asset. Not only that, but it allows you to visualize the price points which the smart money is considering as good bets.

Use the Open Interest to monitor sentiment around key support / resistance levels. Increases in open interest shows investor confidence is growing in that direction. Inversely, reduction in OI contracts can signal a reverse in the other direction

Options Greeks work together with this data. Use Delta, Gamma and IV to see in which way the sentiment is moving around the current price point. This will give you an idea in which direction any potential delta hedging is taking place

If you're bullish on sentiment, track IV (implied volatility) to confirm or deny it; it should be increasing to confirm bearish sentiment, and dropping to confirm bearish sentiment.